Have A Grip On Analysing Returns

While exploring any investment opportunity, the default question for an investor is, "What is going to be my return?". The answer that usually follows is a simple percentage or an empirical value of profitability. However, this simple percentage can be expressed in many ways and formulas with each having its own significance.

Through this blog, let us untangle the various ways of measurement by looking at Aditya's investment options:

Aditya wants to invest INR 100 today and wants this investment to fetch him INR 300. He has three options for investment with different time periods and uses three different metrics - ROI (Return on Investment), IRR (Internal Rate of Return), and CAGR (Compounded Annual Growth Rate) to evaluate the options:

This analysis shows that despite the same invested amount (INR 100) and the same returns (INR 300), the percentage returns are different for different time periods. The financial jargon for this difference is ‘Time value of money’. To put it in simpler words, the value of INR 300 earned will be higher at the end of one year compared to its value at the end of five or ten years. This means that the money’s worth starts reducing with time. Time is therefore an important factor for evaluating returns.

Let us dive deep into each metric to understand them better:

Return On Investment (ROI):

It is to be noted that ROI remains constant in all of Aditya's investment options. It was 200% at the end of one year, five years and even at the end of ten years. This indicates that ROI does not give any importance to the timing of the returns. It only considers the absolute amount of return generated.

Compounded Annual Growth Rate (CAGR):

CAGR represents the compounded growth rate of the investments made. It helps to estimate the average annual growth over a given time period. One can understand that a single investment doesn't provide a constant rate of return every year, as it varies year on year. And, as one reinvests then one needs to know the profit earned on all the investments together.

Therefore, CAGR comes into play here, So for Aditya's five-year investment, CAGR tells the extent of return provided every year during the tenure. However, this is applicable only if he reinvest gains every year. Unlike, the absolute rate of returns, CAGR takes into account the period for which he stayed invested in the given avenue.

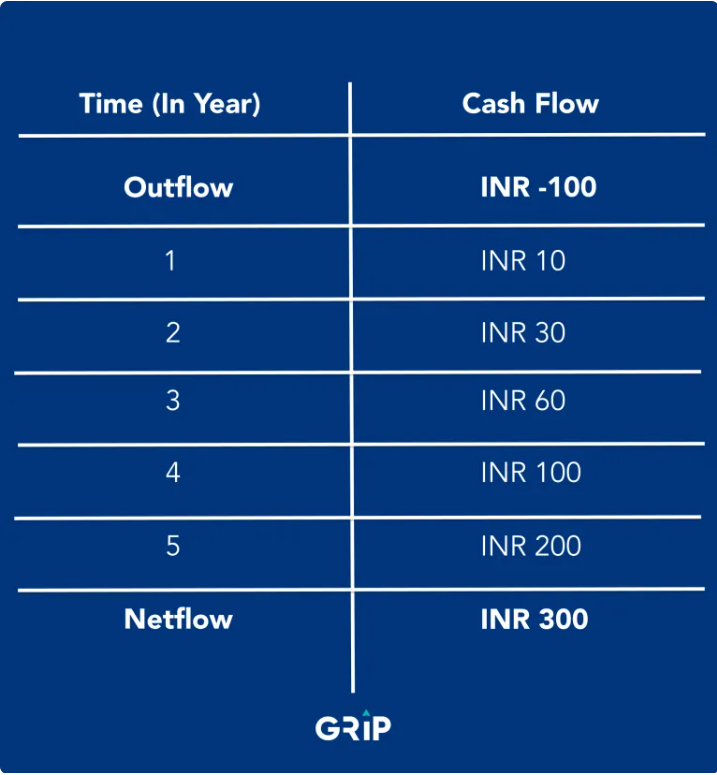

Let’s look at the below table to check the year on year cash flows:

As the table indicates, CAGR gives an overall picture of the return, over the five years, for (INR 100) invested today yielding (INR 300) with a CAGR of 24.57% despite the variable cash flow. For investors like Aditya, It may not be easy to judge the performance based on multiple rates. Therefore, it gets essential to know how it has grown annually, then things may get simpler. This is where CAGR helps by providing a single annual growth rate. Apart from this, it also brings compound interest to the picture to compute returns, making the investors make a call on how they figure their year-on-year returns and for how long!

Internal Rate Of Return (IRR):

Before making any investment, it is natural to do a cost-profit analysis of the same.

Internal Rate of Return is one such measure in the broad realm of profitability ratios that calculates the percentage return earned on each rupee invested and for each period it is invested. It uses the initial cost of the project and projected future cash flows to arrive at the interest rate.

IRR is derived in a manner that the net present value of future cash flows is zero. This derived rate of return is what one can expect to earn from the investment.

Thus, with the mentioned investment opportunity, IRR varies over the period of one year, five years, and ten years. A five-year investment gives an IRR of 42.82%, whereas the same amount invested for ten years with the expected value of (INR 300) generates 25.28%. So Aditya's investment will be dependent on how long he plans to invest and whether the IRR will meet or surpass his desired return criteria or not.

Investors like Aditya, primarily use this metric to estimate the profitability of investments or projects consideration. The higher an internal rate of return, the more desirable an investment is to undertake.

Wrapping It Up:

Different metrics serve a different purposes and help measure different aspects of an investment decision.

ROI, IRR, and CAGR remain the same for a year but for longer investments, they tend to differ. As ROI helps to know about the total growth or return on the investment but not about the annualized one, IRR takes account of all the cashflows - negative and positive and depicts the annualized growth rate. But, when it comes to CAGR, it only considers the investment’s beginning value, ending value, and time period.

Therefore, to vision the investment opportunity, these metrics oil the uncertain road with their specialized view, together or alone. Analyzing this helps the investor gain an insight into the return profile of an investment opportunity and make an informed decision.

Want to stay at the top of your finances?

Join the community of 2.5 lakh+ investors and learn more about Grip Invest, the latest financial knick-knacks and shenanigans that take place in the world of investing.

Happy Investing!

Disclaimer - Investments in debt securities are subject to risks. Read all the offer-related documents carefully. The investor is requested to take into consideration all the risk factors before the commencement of trading. This communication is prepared by Grip Broking Private Limited (bearing SEBI Registration No. INZ000312836 and NSE ID 90319) and/or its affiliate/ group company(ies) (together referred to as “Grip Invest”) and the contents of this disclaimer are applicable to this document and any and all written or oral communication(s) made by Grip Invest or its directors, employees, associates, representatives and agents. This communication does not constitute advice relating to investing or otherwise dealing in securities and is not an offer or solicitation for the purchase or sale of any securities. Grip Invest does not guarantee or assure any return on investments and accepts no liability for the consequences of any actions taken based on the information provided. For more details, please visit https://www.gripinvest.in/.

Registered Address - 106, II F, New Asiatic Building, H Block, Connaught Place, New Delhi 110001.