Hedge Fund Vs Mutual Fund: Key Differences Indian Investors Must Know In 2025

The average asset under management of the different mutual fund types in India stood at INR 74,79,156 crore. Backed by rapid economic growth, the investment landscape of India is witnessing an increased investor interest. It is a testament to diverse investor participation, given the heterogeneous nature of the Indian population.

The Indus Valley Annual Report 2025 highlighted how the Indian population can be divided into three baskets based on their income. With the top 10% having 2/3rd of the total discretionary expenditure of India, 23% contributing 1/3rd, and the remaining 2/3rd using their savings, each class may require an investment medium fit for their needs.

Therefore, while every investor needs diversification, the investment medium must be chosen based on current income and future goals. Therefore, this blog discusses in detail the flip sides of the same coin, hedge fund vs mutual fund.

Hedge Fund VS. Mutual Fund: Detailed Breakdown

Understanding the difference between mutual fund and hedge fund in India requires a thorough breakdown of their meaning, individually. Therefore, let’s explore the concept of mutual funds.

1. Mutual Fund

Mutual funds are managed by experienced fund managers who allocate the pool of funds collected from different investors in a range of assets. For example, the Nippon India large-cap fund with a total AUM of INR 43,828.60 crores is managed by Sailesh Raj Bhan and Bhavik Dave.

Now, there are different types of mutual funds. They can differ based on their asset allocation, investment philosophy, financial goal, etc. Some of the most common mutual fund types and the SEBI mutual fund regulations are discussed below.

| Different mutual fund types | SEBI Limitations of the category |

| Large-cap funds | Minimum 80% allocation in large-cap stocks |

| Small-cap funds | Minimum 65% allocation in small-cap stocks |

| Corporate bond fund | At least 80% allocation in the highest-rated assets |

A concept very similar to mutual funds, yet distinct, is that of hedge funds. Therefore, after mutual funds, the next avenue to explore is how hedge funds work in India.

2. Hedge Fund

Hedge funds are categorised by SEBI as alternative investment options in India. Precisely, it comes under the AIFs category III, according to regulation 3(4)(c).

Hedge funds in India are high-net-worth investment options. They are private entities that pool the funds of investors and allocate them into a range of securities or assets. They use complex techniques and can use leverage. It includes a fund of funds and comes under the purview of SEBI. Discussed below are some SEBI regulations for hedge funds.

- It cannot have more than 1000 investors.

- They are privately pooled, so no advertisements can be made.

- An AIF scheme must have a minimum corpus of INR 20 crores.

- The investment amount of an investor must be at least INR 1 crore.

The table below summarises the basic point of difference between a hedge fund vs mutual fund.

| Parameter | Mutual Fund | Hedge Fund |

| Key difference | Popular and accessible source of investment. | Positioned for high-net-worth individuals |

| Nature of security | Listed shares, debt instruments, cash and cash equivalents. | Can contain very risky assets like unlisted stocks of companies. |

| Minimum investment | Systematic Investment Plans can start from INR 500 to INR 1000. | Minimum investment of INR 1 crore is mandated by SEBI. |

| Number of investors | No maximum number. | Maximum 1000 investors. |

| Strategy | Differs from fund to fund. | Differs based on type but is usually used to invest in high-stakes assets. |

However, comparison of investment avenues is incomplete without exploring their returns. Therefore, let’s compare mutual fund vs hedge fund returns.

Hedge Fund vs Mutual Fund: Returns and Risk

The blog has already established that the degree of risk in some hedge funds in India might be higher than that of mutual funds due to the nature of their investment. Moreover, the category average returns of different mutual funds vary. Therefore, to establish a fair comparison, we shall compare small-cap equity mutual funds with hedge funds.

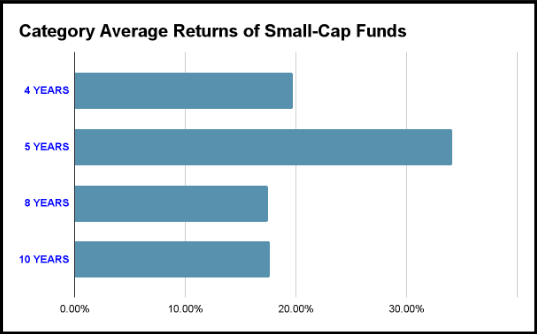

The three-year category average of small-cap funds is 26.29%. The top performer in the category recorded a return of 36.46, whereas the lowest return recorded was 18.30. However, as we increase the time threshold, the category average takes a roller-coaster ride, as reflected in the table below.

Hedge funds in India are still in their nascent stage of development and are private. Therefore, to explore how hedge funds work in India, let’s take a global view.

Globally, the largest hedge fund achieved double-digit returns in 2024. While in 2023 the average return was around 5.7%, in 2024 it hit 10.7%. Since these numbers seem conservative compared to mutual funds in India, it is important to remember markets like the US are mature developed economies with limited growth. The graph below shows the risk-adjusted growth of equity hedge funds.

Now, risk is not the only thing that diminishes returns. Costs related to mutual fund vs alternative investment are key comparisons too.

Fees, Liquidity, and Transparency

Discussed below are some important parameters that investors must consider before investing.

- Hedge fund fees vs mutual fund fees: In the case of mutual funds, the expense ratio refers to the annual percentage of the fund’s assets used to meet operational expenses like management fees. Furthermore, exit load refers to the fee charged when investors want to redeem their shares.

Moreover, hedge funds follow the 2 and 20 model. It implies that 2% is usually the annual management fee, and 20% of the profit earned, above a benchmark, goes to the fund manager or house.

When these fees increase, the profit available for investors falls. - Liquidity: Often, lock-in periods can diminish the liquidity of a fund. Investors must check the factsheet of a fund to ascertain such conditions.

The differences between hedge fund vs mutual fund must have emphasised that investor suitability is key to choosing between the two.

Who Should Invest In What?

The points below might enable a better understanding of the suitability of mutual fund vs hedge fund for beginners and other investor groups.

- Mutual funds might suit retail Investors or first-time savers. Especially, through SIP, investors can start investing with limited funds.

- Hedge Funds are directed towards HNIs, UHNIs, and aggressive investors due to their focused investing approach.

Conclusion

Hedge fund and mutual fund are like the flip side of the same coin. Both create a pool of funds to diversify asset allocation. However, hedge funds are targeted towards HNIs. It is advised that investor should keep their portfolio diversified with fixed income instruments along with market-linked investments. At Grip Invest, you can invest in fixed income opportunities like Corporate Bonds, Securitised Debt Instruments (SDIs), Corporate Fixed Deposits and Debt Mutual Funds. Sign up on Grip Invest today, your one-stop destination for fixed income investments.

Frequently Asked Questions On Hedge Funds Vs Mutual Funds

1. Why are hedge funds considered risky?

Hedge Funds are considered risky due to the nature of their investment and a high minimum investment of INR 1 crore ascertained by SEBI. They invest in assets like unlisted stocks, commodities, etc.

2. Are hedge funds regulated in India?

Hedge funds are registered as alternative investment funds under AIF category III, as per SEBI regulations. Although they are not as popular in India as in international markets, they exist and are regulated.

3. Is a mutual fund safer than a hedge fund?

Risk is the cost of return. Every investment medium has a degree of risk associated with it. Investors might opt for an investment avenue based on investment goal and risk appetite.

Want to stay at the top of your finances?

Join the community of 4 lakh+ investors and learn more about Grip Invest, the latest financial knick-knacks, and shenanigans in the world of investing.

Happy Investing!

Disclaimer - Investments in debt securities/municipal debt securities/securitised debt instruments are subject to risks including delay and/ or default in payment. Read all the offer related documents carefully. The investor is requested to take into consideration all the risk factors before the commencement of trading.

This communication is prepared by Grip Broking Private Limited (bearing SEBI Registration No. INZ000312836 and NSE ID 90319) and/or its affiliate/ group company(ies) (together referred to as “Grip”) and the contents of this disclaimer are applicable to this document and any and all written or oral communication(s) made by Grip or its directors, employees, associates, representatives and agents. This communication does not constitute advice relating to investing or otherwise dealing in securities and is not an offer or solicitation for the purchase or sale of any securities. Grip does not guarantee or assure any return on investments and accepts no liability for consequences of any actions taken based on the information provided. For more details, please visit www.gripinvest.in

Registered Address - 106, II F, New Asiatic Building, H Block, Connaught Place, New Delhi 110001